There has been no shortage of disruptions and challenges this year. Whether it’s the election year or the ripple effects of the global pandemic, uncertainty is prevalent. RateLinx partnered with Supply Chain Dive in July 2020 to conduct a survey to logistics and supply chain professionals to better understand the effects on the supply chain industry. The survey looked closely at logistics technology and visibility in the face of supply chain uncertainty.

In this era of unpredictable supply chain disruptions, reliable data and high visibility are crucial. Especially for building resilient supply chain networks that can weather uncertainty. The prevailing emphasis in the logistics survey results shows a focus on cutting costs, data quality, and optimizing technology solutions for today’s supply chains in the wake of the disruption events of 2020.

Our survey reached C-suite level professionals in supply chain management, operations, and transportation positions. Respondent’s organizational composition included manufacturing, distribution, retail, and agricultural organizations, with nearly 75% from manufacturing and distribution.

Here, we dive deeper into the results to discuss the findings with three industry professionals. They discuss how supply chains address these challenges and where there are areas for improvement.

Disruption events compound supply chain challenges

By the second quarter this year, supply chains had been struggling with many challenges, including unanticipated black swan events. Not surprisingly, survey participants showed the top event of the past three years that continues to disrupt transportation operations is the COVID-19 pandemic. Not so close behind, companies cited trade wars and tariffs, and capacity shortages.

We checked in with Nate Endicott, Senior VP of Global Sales and Alliances at RateLinx, for his perspective. Nate is not startled by these statistics. He believes capacity will be tight through the pandemic until at least Q2 of 2021. Endicott says he wouldn’t be surprised if UPS and FedEx place capacity limits on the big retailers. Add the pandemic and peak season to capacity restraints, and you have a perfect storm for ongoing capacity challenges.

Jeff Dudzik, Global VP of Carrier Management at RateLinx, gave us another perspective. Dudzik spent over 20 years in global transportation, procurement, and logistics operations. He says back in Q2 of this year, the problem wasn’t in logistics or transportation; it was the inventory level. Capacity was abundant, but supply chains didn’t have enough inventory to move.

“We’ll all remember ‘the great toilet paper shortage of 2020’”, he said jokingly, “No one expected it. Many production floors were already operating at capacity. We can’t build plants overnight to produce more goods.”

Looking ahead to this peak season, Jeff envisions shipping delays through the holiday season. He says companies will need to catch-up, and capacity will be a challenge, but shipping networks will adjust. He expects capacity issues will calm by the middle of February 2021.

Emphasis on cost-savings and system optimization

Supply chains react and shift to new and unexpected challenges. In fact, 49% of the logistics survey respondents cite cutting costs as their top priority to address the destabilizing events’ long-term impacts. Following closely, 47% of survey participants prioritize optimizing existing solutions.

Companies are trying to pull together all their historical logistics data while many networks are not tied together. They need to get all of their data in one place.

As goals, priorities, and responsibilities shifted suddenly for many supply chains this year, cutting costs, increasing efficiency, and planning for the future are top priorities. Supply chain data is the best place to start to identify cost-savings and efficiencies.

Andrew Hooser, VP Strategic Customers at RateLinx, has spent over 12 years in global logistics leadership roles. He says, “Companies are trying to pull together all their historical logistics data while many networks are not tied together. They need to get all of their data in one place.”

Budgets are tight, and staffing is lean, but data insights and cost-savings are needed yesterday. Adding yet another logistics system to the mix is often out of the question. New system implementations are expensive with a long time-to-value. Even then, they often lack the necessary integration and data quality to deliver data intelligence.

More and more companies today are augmenting their current systems. By enhancing the existing technology stack, organizations spend less capital and introduce less risk. They achieve greater results in less time-to-value than new system implementations.

Like what you’re reading?

Actionable insights are only as good as the data

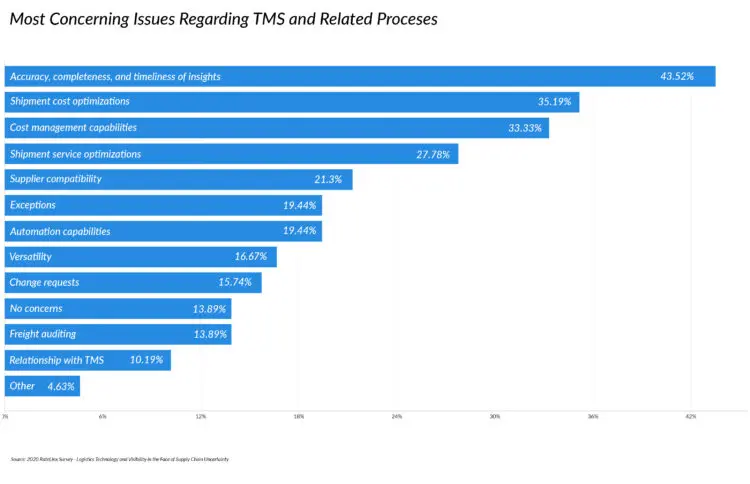

Unfortunately, many organizations find their data is in several different systems, spreadsheets, and files that need cooperation and access from people across various vendors and departments. Getting the insights supply chain professionals need now is a problem. In fact, 43% of survey respondents cited the accuracy, completeness, and timeliness of insights as their primary concern with current TMS and related processes.

Endicott finds this fascinating. He says, “The TMS is not a visibility tool. It is not designed to provide insights to make changes internally.”

However, the focus on insights doesn’t surprise him. “They want data that is accurate, complete, and timely—they need it now. Not to answer last week’s questions, but to be proactive so they can take action on what’s happening now,” says Nate. “It’s no surprise—they’re not getting the visibility they need by going to multiple systems and providers.”

Further calling attention to this focus on data, 44% of the logistics survey participants said less than 25% of their company’s data sources are integrated to provide insight into their transportation and logistics operations. And only 8% indicated more than 75% of their data sources were integrated.

When you’re in charge of running logistics for your company, you can’t pay attention to everything going on. Having prescriptive insights available means you can be alerted to issues you wouldn’t otherwise know about.

When cost-savings and improving operational efficiencies are crucial, insights with timely, accurate, and complete data integration is critical. With siloed data, insights are out of reach, leaving logistics and supply chain professionals making decisions by guesswork. Or likely, spending time on tedious, manual work to chase down data to answer what happened yesterday. Instead, the focus should be on making smart, data-driven decisions to affect what happens tomorrow and next week.

The path into 2021 and beyond

Dudzik and Hooser commented on supply chains struggling with a lack of quality data and insights. They stress that the most important supply chain metrics revolve around costs and customer service. Successful initiatives to improve service and reduce costs must have actionable and prescriptive insights.

“When you’re in charge of running logistics for your company, you can’t pay attention to everything going on,” Dudzik says. “Having prescriptive insights available means it can alert you to issues you wouldn’t otherwise know about.”

Jeff illustrates this with an example. Let’s say you typically spend $3M a day in transportation, and you receive an alert two weeks into the month that you’re spending $3.5M per day. You can now track down what’s happening and triage it before the month ends. You’ll save costs by correcting future issues before they occur.

Hooser elaborates on the importance of insights for monitoring customer service. This could be service to your distributors, vendors, retailers, or the end consumer. Ultimately, your customers expect their shipments to arrive on time.

In a ubiquitous example, a shipment is arriving late. You could just let the shipment run its course. But that won’t help you deliver a superior customer experience. You really need to know it’s going to be late before-hand. This way, you can decide whether to re-route, pay extra to deliver on time, or, if nothing else, inform the customer proactively of a late delivery.

With machine learning and artificial intelligence technology, supply chains can now leverage tools to react quickly with prescriptive insights. These insights enable supply chains to digitize the decision-making process. By doing so, it empowers shippers to confidently take action and prevent adverse business outcomes.

The bottom line: Companies plan for new solutions

The results of this logistics survey with Supply Chain Dive and RateLinx, bring to the forefront the challenges supply chains continue to face this year in the wake of disrupting events. Many supply chains are still struggling with logistics system limitations, poor data quality, and, ultimately, a lack of actionable prescriptive insights to drive improvements in their operations. Consequently, it’s not surprising over 72% of survey participants plan to implement new logistics software in the near future.